south dakota motor vehicle sales tax rate

Searching for a sales tax rates based on zip codes alone will not work. Home Motor Vehicle Sales Tax Calculator.

Titles Licensing Lawrence County Sd

Enter a street address and zip code or street address and city name into the provided spaces.

. Sales Tax of 4 Is Due Only If You Have Not Paid Sales Tax Previously. 2022 South Dakota state use tax. Like in Montana maybe RVers chose South Dakota RV registration for tax reasons.

If You Paid 3 Sales Tax South Dakota Will Charge You 1 Sales Tax. For additional information click on the links below. 1000 when applicable Administrative Fee.

The South Dakota use tax is a special excise tax assessed on property purchased for use in South Dakota in a jurisdiction where a lower or no sales tax was collected on the purchase. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. Car sales tax in South Dakota is 4 of the price of the car.

The SD use tax only applies to certain purchases. 36-144 based on weight. No car buying is complete without hefty sales taxes.

In South Dakota an ATV MUST be titled. The South Dakota excise tax on liquor is 463 per gallon lower then 62 of the other 50 states. Motor vehicle titling and registration.

However there are a few differences to consider. For vehicles that are being rented or leased see see taxation of leases and rentals. Variable see below County Wheel Tax.

Sales Tax Rates for Nonresident Purchasers. An additional 2 wholesale tax applies to the sale of wine or spirits in South Dakota. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date.

Imposition of tax--Rate--Failure to pay as misdemeanor. South Dakota - 4. Purchasers in South Dakota are charged a 4 excise tax which is much lower than most states and South Dakota has low registration fees as well.

Repealed by SL 1990 ch 230 7. SDCL 10-46 The state sales and use tax rate is 4. 31 rows The state sales tax rate in South Dakota is 4500.

The purchaser or consumer of the goods or services is respon-sible for reporting and remitting the use tax in the filing period in which they receive the goods or services. The state also has no state income tax and a low sales tax 45 and its easy to establish residency in the state. What Rates may Municipalities Impose.

Car tax as listed. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. 1 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases Motor Vehicle Sales and Purchases.

Plus 03 motor vehicle salesuse tax. However the car sales tax varies by state and some states dont even charge tax. Only some SD counties.

If any motor vehicle has been subjected previously to a sales tax use tax motor vehicle excise tax or similar tax by this or any other state or its political subdivision no tax is owed. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. South Dakota 4 special vehicle rate Tennessee 7 single article tax not applicable Texas 625 Utah 485 Vermont 6.

2500 all transactions done through the mail PostageHandling Fee. 775 for vehicle over 50000. Most states charge sales tax on vehicles.

Motor vehicle dealers must use Indiana sales tax return ST-103CAR. With local taxes the total sales tax rate is between 4500 and 7500. South Dakota Codified Laws 32-5B-21 32-5B-21.

You can find these fees further down on the page. Initiated in 1986 to help subsidize bridge and highway maintenance you pay the South Dakota wheel tax when you are registering your vehicle with the South Dakota Department of Revenue DOR. South Dakotas excise tax on Spirits is ranked 31 out of the 50 states.

South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles See Table 1 4 State Sales and Use Tax applies to all sales or purchases of taxable products and services. For starters South Dakota charges a 4 excise tax. Most states in the US charge sales tax on cars.

Processing Fee For Renewals 29 For Up To Five Vehicles. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax. 31 rows The state sales tax rate in South Dakota is 4500.

Car Sales Tax by State. Click Search for Tax Rate. The RV registration fee is also very reasonable.

Below we list the state tax rate although your city or county government may add its own sales tax as well. With few exceptions the sale of products and services in South Dakota are subject to sales tax or use tax. 19 For Each Additional Vehicle More Than Five.

Rhode Island - 7. One exception is the sale or purchase of a motor vehicle which is subject to the motor vehicle excise tax. Learn which goods services are taxable and how to register and file with your state.

The South Dakota use tax should be paid for items bought tax-free over. Reassignment of other SD Plates. What is South Dakotas Wheel Tax.

When calculating the sales tax for this purchase Steve applies the 4000 state tax rate for South Dakota plus 2500 for Aberdeens city tax rate. That said this RV tax is still much lower than in most states. Transactions with Plates 500 per set.

Registering with your own SD plates. However the average total tax rate in South Dakota is 5814. With local taxes the.

75 hybrid fee 150 annual EV fee. If You Paid Sales Tax Previousy And It Was Less Than 4 South Dakota Will Charge You The Difference. South Dakota on which South Dakota sales tax was not paid.

However if purchased by an out of state business you will need to show proof of tax paid to your local Department of Revenue office. For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. As the name implies you pay a certain amount for each tire depending on your vehicles weight class and county.

4 The following taxes may apply in addition to the state sales tax. 635 for vehicle 50k or less. Applies to all sales of.

In the table below we show the car sales tax rate for each state. South Dakota is another popular state for purchasing and registering RVs. The South Dakota liquor tax applies to all hard alcohol alchoholic beverages other then.

Everything business owners need to know about South Dakota sales tax. States with High Sales Tax. 425 Motor Vehicle Document Fee.

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

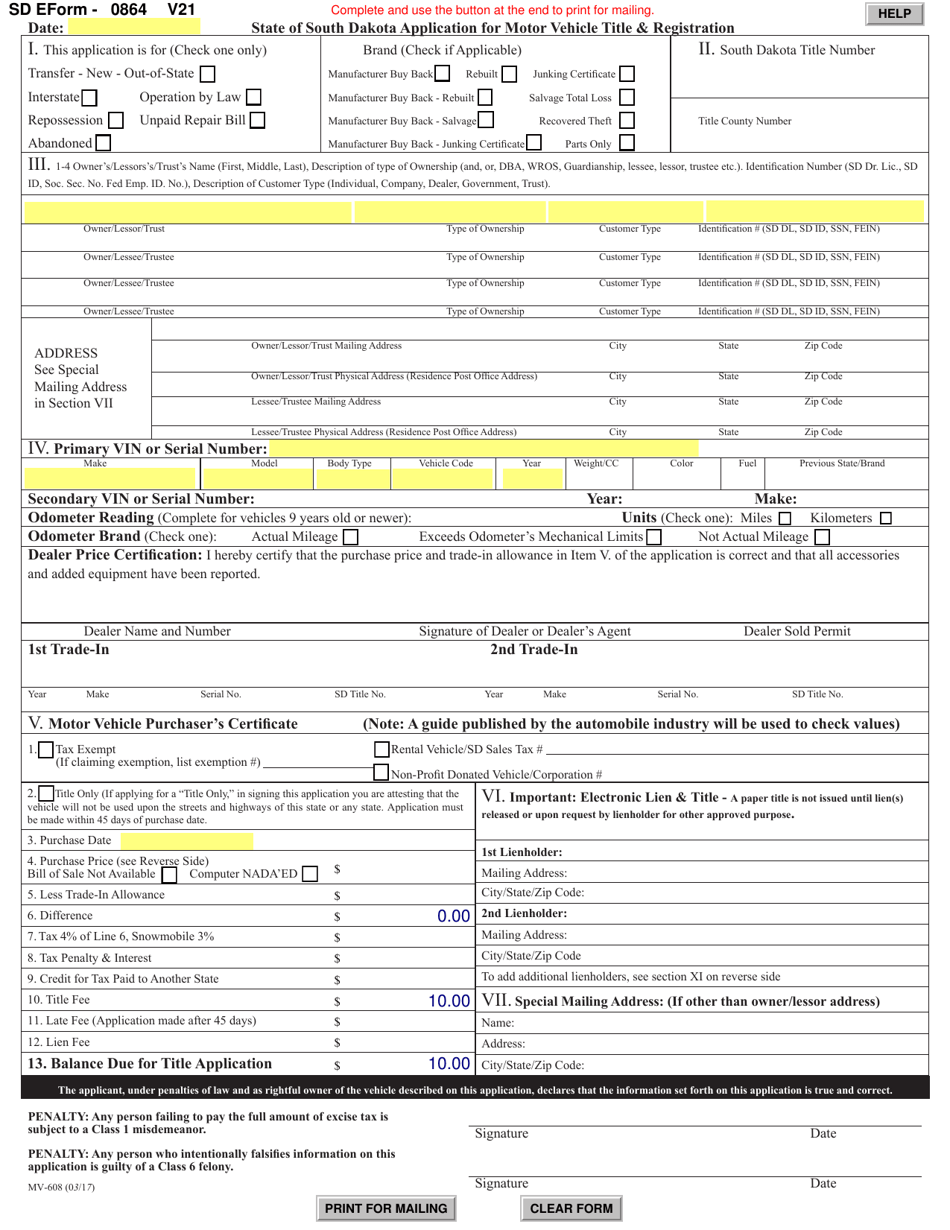

Sd Form 0864 Mv 608 Download Fillable Pdf Or Fill Online Application For Motor Vehicle Title Registration South Dakota Templateroller

Cars Trucks Vans South Dakota Department Of Revenue

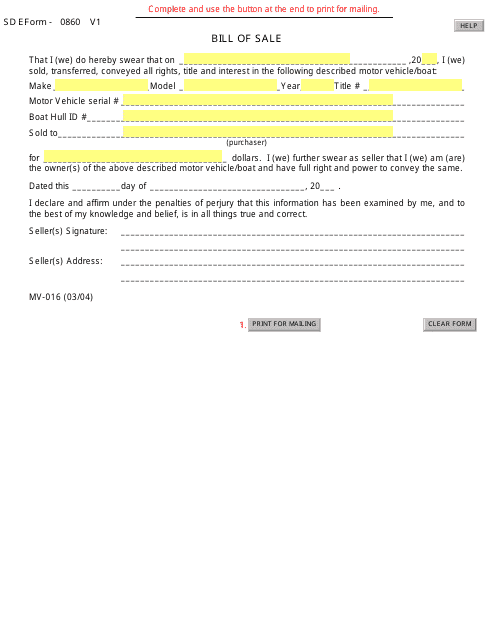

Form Mv 016 Sd Form 0860 V1 Download Fillable Pdf Or Fill Online Bill Of Sale For Motor Vehicle Boat South Dakota Templateroller

Car Tax By State Usa Manual Car Sales Tax Calculator

Access Vehicle Records By Submitting Your Request In Minutes South Dakota Department Of Revenue

Sales Tax On Cars And Vehicles In South Dakota

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

Sd Form 0864 Mv 608 Download Fillable Pdf Or Fill Online Application For Motor Vehicle Title Registration South Dakota Templateroller

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

Dealer Requirements License Plates South Dakota Department Of Revenue

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Tax Collections Eclipse 1 26 Million At Sturgis Motorcycle Rally South Dakota Department Of Revenue

South Dakota Sales Tax Small Business Guide Truic

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

What S The Car Sales Tax In Each State Find The Best Car Price

Free South Dakota Bill Of Sale Forms Pdf

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba